Step 1: Decide if You Need Life Insurance

Buying life insurance is a sound move if you have anyone who relies on you financially, like aging parents, a spouse, children who will be needing education expenses covered, and so on. The idea is that it’s meant to replace your “value” when you die, like your salary. Life insurance is designed for younger people and families to buy into and can get much more expensive to purchase as you get older since you become riskier to insure. There’s less of a need for life insurance once you’ve reached retirement age since your dependents are likely now financially independent and you’re now living off your retirement savings. Even at retirement, however, some people will choose to hang onto their life insurance simply as a way to pay for their funeral costs and burial expenses, which can be costly.Step 2: Decide What Type of Life Insurance to Buy

There are several types of life insurance, but the two main ones to know about are term life insurance and whole life insurance.Term life insurance

Term life insurance is the most common and affordable. You make fixed-rate payments and receive coverage for a pre-specified period of time. Most providers offer coverage for 5, 10, 15, 20, and even 30 years, which can be renewed when expired. You can also select the policy amount, such as $250,000, $500,000, or more. If you die within your term policy, your beneficiary will receive this payout—also known as the “death benefit”. When shopping for term life insurance, you want to think about the number of years your dependents will be relying on you so they’re covered in the case that you die. For example, if you have a newborn baby and anticipate upcoming childcare costs and a college education down the road, a 20-year life insurance policy would cover that entire period of time. At the end of the 20-year term, you can decide if you’d like to renew your policy or let it expire, but ideally, your need for life insurance will end when your term ends.Whole life insurance

Whole life insurance falls under the umbrella of permanent life insurance, like universal life insurance. It’s a policy that covers that never ends and covers you forever. It also comes with an investment component where the cash value increases over time in a tax-deferred account. This means that you won’t have to pay any taxes on the gains while it accumulates. Here are a few more quick facts about a whole life insurance policy:- The premium you pay is fixed, even as you age

- You can borrow money against the account or even abandon your policy for cash (but you’ll no longer have coverage. A personal loan may be a better choice if you’re in need of quick funding.)

- The rate at which the cash value of the account grows is guaranteed

- Some policies earn annual dividends

Step 3: Choose a Reputable Provider

It’s important to choose a life insurance company that has the financial strength to pay a claim, whether it’s five years from now or 30. When you’re doing research and checking online reviews for an insurance provider, here’s what you want to look out for:- Are they paying their claims? Some life insurance companies will try and avoid paying a death benefit for any reason they can find, which is a shady practice.

- Do they cancel policies without good reason? Some insurers will cancel a policy if you fall behind on just one payment, which isn’t acceptable for a reputable company.

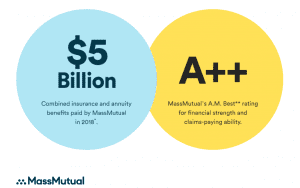

- Is the insurer financially strong? You can find out a company’s financial stability by checking third-party reviewing agencies, like J.D Power, Better Business Bureau (BBB), and A.M Best.

- Check to see how their customer service is. It’s important to be able to reach out to a representative if you have questions about your policy. You can see what online reviews say or test them out yourself by sending an email or calling up a provider.

* Source: MassMutual 2018 Annual and Corporate Responsibility Report

Step 4: Request Quotes

Once you have a handful of reputable insurers, it’s time to get some quotes so you can compare life insurance rates since a majority of companies won’t offer this information on their website. This is an easy and straightforward step you can do online. Most life insurance companies will offer an online quote generator tool that will ask for some of your information to calculate your personalized rate. Here is some of the information you’ll need to provide when requesting quotes:- You contact information, like name, age, and address

- The desired coverage amount

- Gender, height, and weight

- Lifestyle questions, like if you smoke, vape, etc

- Occupation

- Citizenship status

- Medical history questions

Step 5: Application Process

Now that you’ve requested quotes and have found the best life insurance rate and policy that fit your needs, the final step is the application process. You can fill out most applications online and you’ll need to provide some additional information, like your social security number and driver’s license number. It’s also common for providers to request a life insurance medical exam, which is like a typical yearly physical exam where your doctor will check things like your vitals, blood pressure, and take a blood sample. Once you submit your application, your insurer may also require a phone interview to confirm your information and ask for a few additional details. You’re done! Since there’s a lot of information to verify, including a medical exam, approval can take a few weeks or even a month. Sproutt is a life insurance company that doesn’t require a medical exam so you can get insured quicker. All you have to do is fill out the application form and wait to get approved.

Final Thoughts

As you’ve seen by reading this article, buying life insurance isn’t a complicated endeavor. All it takes is just a bit of research to find the best life insurance rates from a reputable lender.Article Topics